![]()

A column on #transhumanism I did for Flaunt:

Are you ready for the future? A Transhumanist future in which everyone around you—friends, family, and neighbors—has dipped into the cybernetic punch bowl? This is a future of contact lenses that see in the dark, endoskeleton artificial limbs that lift a half-ton, and brain chip implants that read your thoughts and instantly communicate them to others. Sound crazy? Indeed, it does. Nevertheless, it’s coming soon. Very soon. In fact, much of the technology already exists. It’s being sold commercially at your local superstore or being tested in laboratories right now around the world.

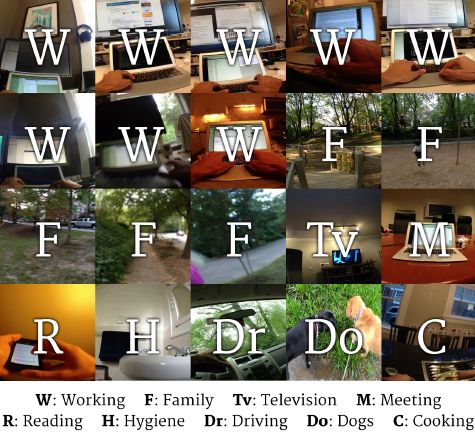

We’ve all heard about driverless test cars on the roads and how doctors in France are replacing people’s hearts with permanent robotic ones, but did you know there’s already a multi-billion dollar market for brainwave-reading headsets? Using electroencephalography (EEG) sensors that pick up and monitor brain activity, NeuroSky’s MindWave can attach to Google Glass and allow you to take a picture and post it to Facebook and Twitter just by thinking about it. Other headsets allow you to play video games on your iPhone with only your thoughts as well. In fact, a few months ago, the first mind-to-mind communication took place. A researcher in India projected a thought to a colleague in France, and using their headsets, they understood each other. Telepathy went from science fiction to reality, just like that.

The history of cybernetics—sometimes used to describe robotic implants, prosthetics, and cyborg-like enhancements in the human being and its experience—has come a long way since scientists began throwing around the term in the 1950s. What a difference a generation or two makes. Today a thriving pro-cyborg medical industry is setting the stage for trillion-dollar markets that will remake the human experience. Five million people in America suffer from Alzheimer’s, but a new surgery that involves installing brain implants is showing promise in restoring people’s memory and improving lives. The use of medical and microchip implants, whether in the brain or not, are expected to surge in the coming years. NBC News recently reported that many Americans will likely have chip implants within a decade’s time. It’s truly a new age for humans.

Standing proud at the forefront of all this change is the fascinating biohacker culture, where extreme inventors and innovators are leading the way by sticking RFID tracking chips in their bodies, permanent wireless headphones near their eardrums, and magnets in their fingers.