Year 2021 This also another use for air pollution into diamonds.

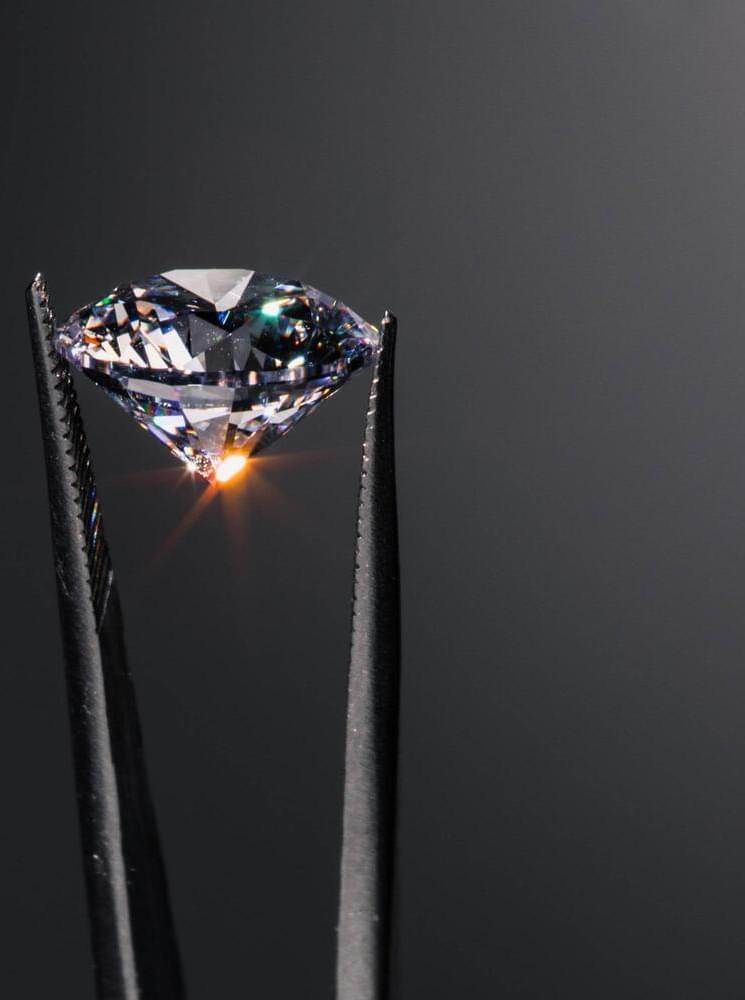

Mining diamonds is a notoriously destructive and exploitative process, both socially and environmentally. On a mission to produce diamonds sustainably and ethically, one company discovered a way to—quite literally—pull diamonds out of thin air.

According to the International Gem Society, 250 tons of soil are moved for each carat of mined diamond, wreaking havoc on ecosystems, wildlife, and the water table. Nearly 20 years have passed since the United Nations established the Kimberley Process, a certification to address human rights abuses in the mining industry and eradicate conflict diamonds from the global market. Also known as “blood diamonds,” conflict diamonds are mined in rebel-controlled areas and sold to help finance armed conflicts. The Human Rights Watch says that rebel rule, forced labor, and violence are still rampant in the industry.

Several years ago, Ryan Shearman was speaking to Dan Wojno, a former colleague from the jewelry industry who was living in Bangkok at the time. Wojno reported that air pollution in the area was so bad on some days that people wore masks. Inspired, they hatched an idea: If air pollution is mostly carbon-based, and diamonds are purely carbon, then why can’t we make diamonds directly from pollution?