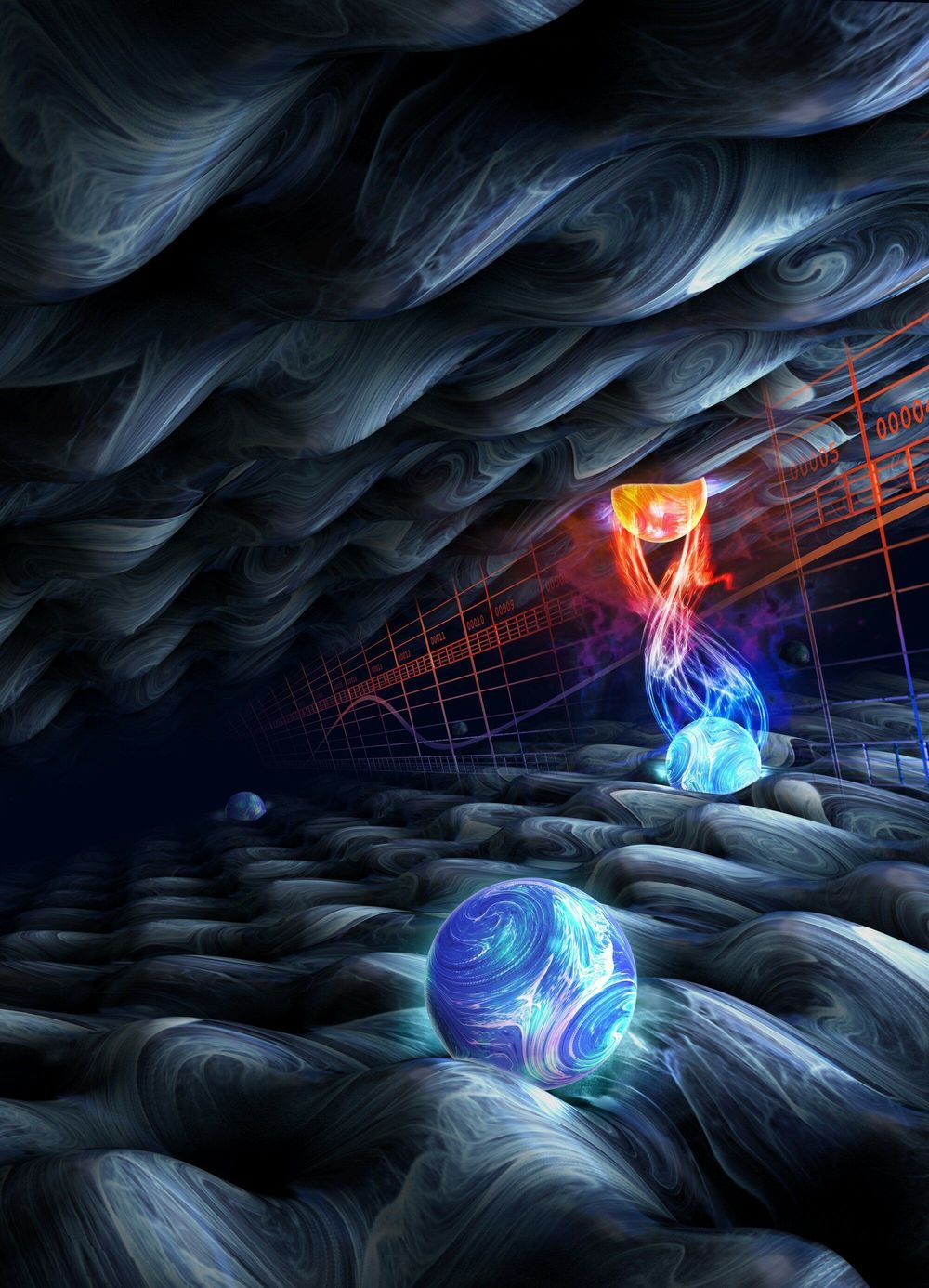

Shaking a physical system typically heats it up, in the sense that the system continuously absorbs energy. When considering a circular shaking pattern, the amount of energy that is absorbed can potentially depend on the orientation of the circular drive (clockwise/anti-clockwise), a general phenomenon known as circular dichroism.

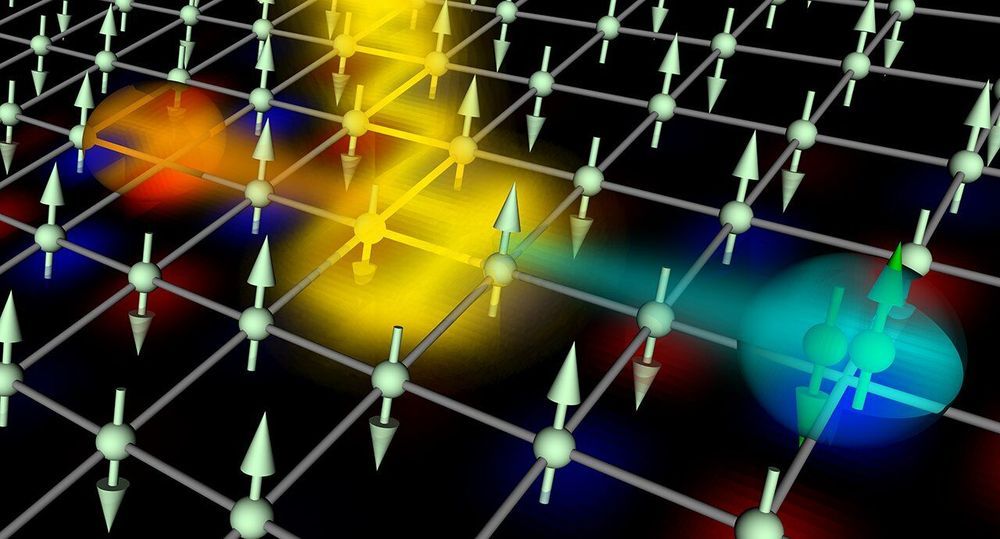

In 2017, Nathan Goldman (ULB, Brussels), Peter Zoller (IQOQI, Innsbruck) and coworkers predicted that circular dichroism can be quantized in quantum systems (heating is then constrained by strict integers) forming a “topological state.” According to this theoretical prediction, the quantization of energy absorption upon circular driving can be directly related to topology, a fundamental mathematical concept that characterizes these intriguing states of matter.

Writing in Nature Physics, the experimental group of Klaus Sengstock and Christof Weitenberg (Hamburg), in collaboration with the team of Nathan Goldman, reports on the first observation of quantized circular dichroism. Following the theoretical proposal of Goldman, Zoller et al., the experimentalists realized a topological state using an ultracold atomic gas subjected to laser light, and studied its heating properties upon circular shaking of the gas. By finely monitoring the heating rates of their system, for a wide range of driving frequencies, they were able to validate the quantization law predicted by Goldman, Zoller et al. in 2017, in agreement with the underlying topological state realized in the laboratory.