Worried about security for your bitcoin in the face of quantum computing? According to computer researchers, there’s no reason to be.

Source: https://hacked.com/breathe-easy-bitcoiners-quantum-computing…encryption

Some people assume that once quantum computing comes along modern encryption technologies will be outpowered. But experts are starting to posit that hash functions and asymmetric encryption could defend not only against modern computers, but also against quantum attackers from the future.

Matthew Amy from Canada’s University of Waterloo proposes just this in a paper by the International Association of Cryptologic Research.

Amy, and researchers from Perimeter Institute for Theoretical Physics and the Canadian Institute for Advanced Research, examined attacks against SHA-2 and SHA-3 with Grover’s algorithm.

Grover’s algorithm is a quantum algorithm that finds with high probability the input to black box functions that produce particular, and predictable, output values.

Grover’s algorithm could brute-force a 128-bit symmetric cryptographic key in roughly 264iterations,” Wikipedia states, “or a 256-bit key in roughly 2128 iterations. As a result, it is sometimes suggested that symmetric key lengths be doubled to protect against future quantum attacks.”

Researchers surmise SHA-256 and SHA3-256 need 2166 “logical qubit cycles” to break, and the paper suggests quantum papers pose little threat, though classical processors will need to manage them.

The paper notes: “The main difficulty is that the coherence time of physical qubits is finite. Noise in the physical system will eventually corrupt the state of any long computation,” the paper states. “Preserving the state of a logical qubit is an active process that requires periodic evaluation of an error detection and correction routine.”

With ASICs running at a few million hashes per second, it would take Grover’s algorithm 1032 years to crack SHA-256 or SHA3-256. That is longer than the universe has existed.

As The Register adds: “Even if you didn’t care about the circuit footprint and used a billion-hash-per-second Bitcoin-mining ASIC, the calculation still seems to be in the order of 1029 years.”

SHA-2 is the set of cryptographic hash functions designed by the National Security Agency (NSA), an intelligence branch of the US government under scrutiny for ubiquitous surveillance due to revelations released by Edward Snowden. SHA stands for “Secure Hash Algorithm.”

These hash functions represent mathematical operations run by digital means Cryptographic hash functions boast collision resistance, which means attackers cannot find two different input values that result in the same hash output. The SHA-2 family is comprised of altogether six hash functions with hash values that are 224, 256, 384 or 512 bits: SHA-224, SHA-256, SHA-384, SHA-512, SHA-512/224, SHA-512/256.

SHA-256 and SHA-512 are novel hash functions computed with 32-bit and 64-bit words, respectively.

Financial incentives for miners can be replaced by non-financial awards, such as recognition, governance, gaming, stakeholder lotteries, and exchange reputation points. I am barely scratching the surface. Others will come up with more creative ideas.

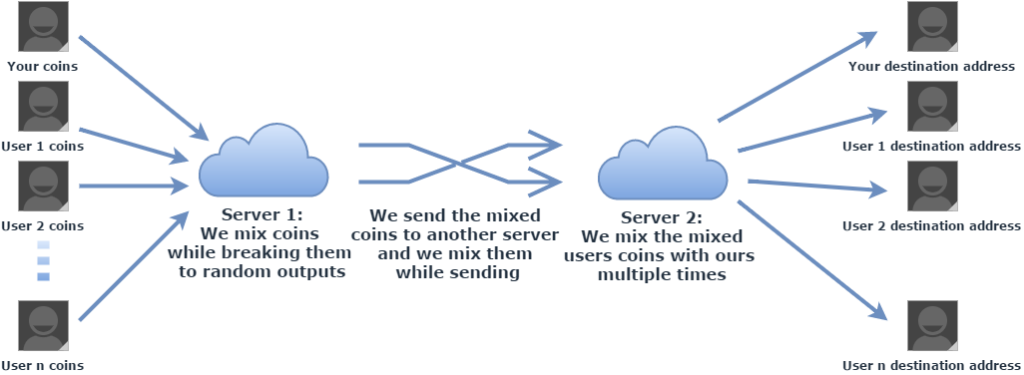

Financial incentives for miners can be replaced by non-financial awards, such as recognition, governance, gaming, stakeholder lotteries, and exchange reputation points. I am barely scratching the surface. Others will come up with more creative ideas. and earnest but misguided attempts to create a registry of ‘tainted’ coins.

and earnest but misguided attempts to create a registry of ‘tainted’ coins.