The LumiWatch projects images onto your arm that respond to touch.

Today we have a report from Open Longevity School: Summer Camp 2018, an initiative in Russia focused on developing a personal health and longevity strategy, Elena Milova went to investigate.

When we ask researchers when, in their opinion, the cures for aging will be ready, we often hear an optimistic answer: 20–25 years. As a well-informed optimist, I add another 10 years to this number, because wherever the therapies appear, it will take time for them to be distributed to other countries and become affordable. I will be happy if it takes less time, but what if it doesn’t? I am nearly 40, and when I add 35 years to my current age, I vividly imagine how my reflection in the mirror will show a 75-year-old lady. Honestly, I don’t want to see my body change, and it can explain why I aspire to get first-hand information about any means to slow down aging as soon as possible. Evidence-based information, of course.

Before I tell you my story of discovering how to control my aging, I must provide a disclaimer. This article does not contain any medical recommendations. The websites of the projects I will tell you about, once again, do not contain medical recommendations and cannot be independently used to make health decisions. The experience I will share, and the activities of the projects I will tell you about, are aimed at teaching you about the existing scientific knowledge about aging and interventions that have the potential to change the way we age. Whatever you decide to implement in your everyday life, please talk to your medical advisor first.

I am always looking for the means to keep myself as young as possible. Luckily for me, in Russia, there is a project focused on collecting this kind of information and making it publicly available. It is Nestarenie.ru (translation: “not aging”), an online encyclopedia created by professional sports trainer, valeologist and citizen scientist Dmitry Veremeenko. The amount of information that Dmitry has managed to process is hard to imagine; it consists of more than 70,000 scientific papers. The development of this database took him several years of work. Each article of his encyclopedia summarizes a specific drug, food or lifestyle element that can slow down or even reverse age-related changes, with a deep explanation of the underlying mechanisms. Each of his information-dense articles has lots of internal links to actual scientific papers (including the freshest meta-analyses) and finishes with a list of additional references.

I am always looking for the means to keep myself as young as possible. Luckily for me, in Russia, there is a project focused on collecting this kind of information and making it publicly available. It is Nestarenie.ru (translation: “not aging”), an online encyclopedia created by professional sports trainer, valeologist and citizen scientist Dmitry Veremeenko. The amount of information that Dmitry has managed to process is hard to imagine; it consists of more than 70,000 scientific papers. The development of this database took him several years of work. Each article of his encyclopedia summarizes a specific drug, food or lifestyle element that can slow down or even reverse age-related changes, with a deep explanation of the underlying mechanisms. Each of his information-dense articles has lots of internal links to actual scientific papers (including the freshest meta-analyses) and finishes with a list of additional references.

If the sun stopped working for 24 hours, what would happen to Earth?

In a breakthrough discovery, University of Wollongong (UOW) researchers have created a “heartbeat” effect in liquid metal, causing the metal to pulse rhythmically in a manner similar to a beating heart.

Their findings are published in the 11 July issue of Physical Review Letters, the world’s premier journal for fundamental physics research.

The researchers produced the heartbeat by electrochemically stimulating a drop of liquid gallium, causing it to oscillate in a regular and predictable manner. Gallium (Ga) is a soft silvery metal with a low melting point, becoming liquid at temperatures greater than 29.7C.

One of the biggest freshwater reservoirs in the world is, literally, up in the air.

Between 6 and 18 million gallons of freshwater hover above every square mile of land, not counting droplets trapped in clouds. Scientists realized this centuries ago but they have never quite figured out how to bring the water down to earth. The effort required to condense it would consume such vast quantities of energy that it has always appeared to make any effort to capture and use this water uneconomical.

But while studying this topic, two of my University of Texas at Austin colleagues and I came up with a concept that might just work: that of using the natural gas that is otherwise flared from oilfields to harvest atmospheric moisture.

Is life extension at… odds with probability?

Does probability ensure that you will die, no matter what, once you are old enough? Does it throw the ultimate spanner in the works of life extension? The answer is not as clear-cut as you might think.

Recently, a study from Sapienza University in Italy has revived the idea of the so-called “mortality plateaus”—the apparent flattening of mortality rates in people aged above 100, suggesting that the maximum mortality rate of such people is 50% at age 105 [1]. However, even if this mortality rate remained constant for as long as you lived, you’d still be overwhelmingly likely to die relatively soon.

What may be even more disheartening is that, if you had a constant, larger-than-zero probability of dying, then no matter how small it was, you’d be overwhelmingly likely to die past a certain point in time, be it even billions of years into the future. As a matter of fact, over an infinite time, that probability would be exactly 100%. However, the situation is not as dire as it seems.

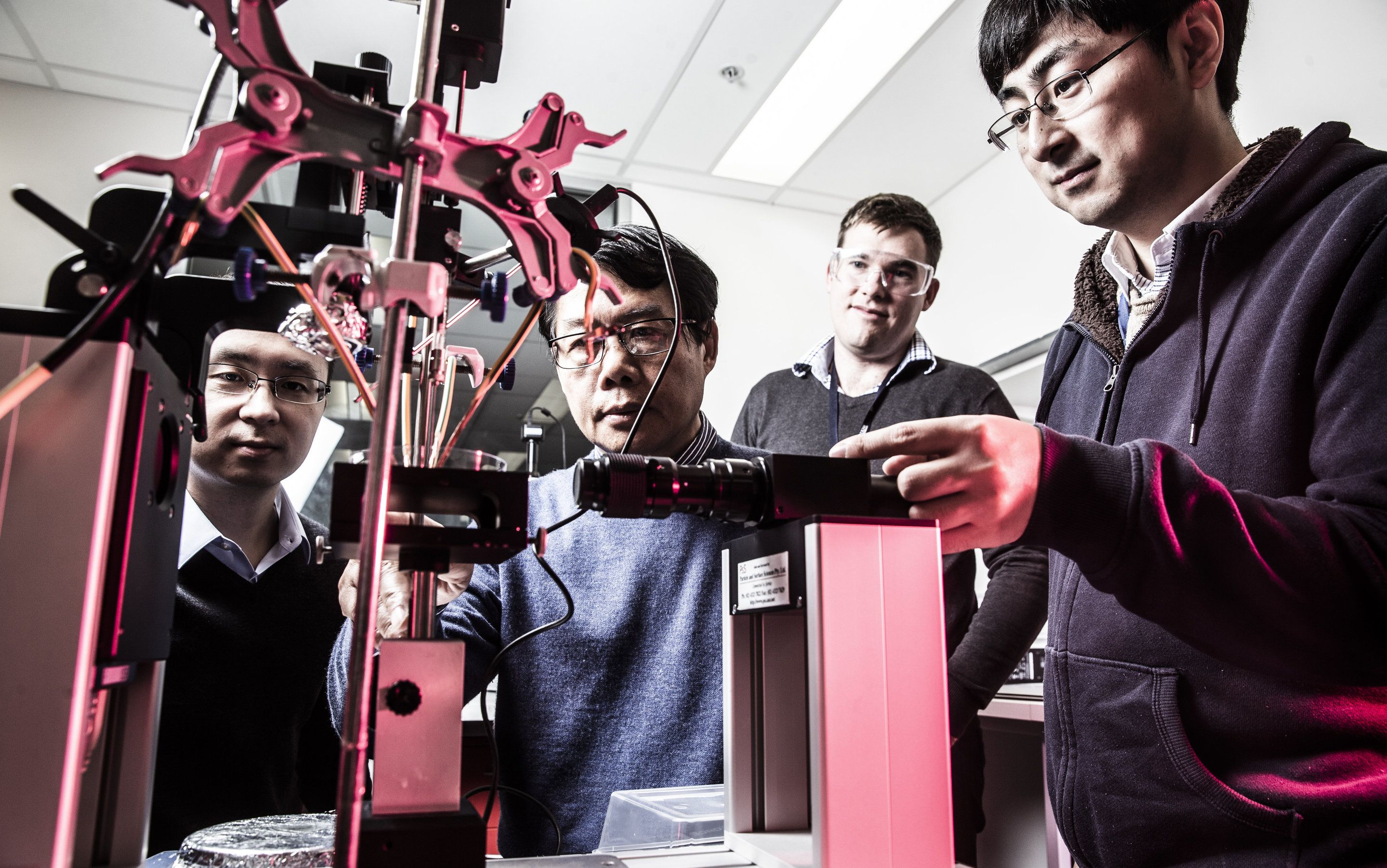

This new 3D-printed bone graft melds with your existing bone, becomes new bone, and can even grow with you. (via National Science Foundation (NSF))

This report covers the 11th edition of the EU-funded MicroNanoBio Systems cluster annual MNBS Bioelectronics Workshop, which took place in Amsterdam at the Beurs van Berlage on 12th-13th December 2017 and was included as part of the International Micro Nano Conference 2017, of which the main topics were Microfluidics and Analytical Systems, Fabrication and Characterization at the Nanoscale, and Organ-on-a-Chip.

Here, the problem is marketing. Around 2bn people eat insects already, but few of them are Westerners. Changing that could be a hard sell. Grind the bugs up and use them as ingredients, though, and your customers might find them more palatable. Hargol FoodTech, an Israeli startup, plans to do just that. Locust burgers, anybody?

MOST people like to eat meat. As they grow richer they eat more of it. For individuals, that is good. Meat is nutritious. In particular, it packs much more protein per kilogram than plants do. But animals have to eat plants to put on weight—so much so that feeding livestock accounts for about a third of harvested grain. Farm animals consume 8% of the world’s water supply, too. And they produce around 15% of unnatural greenhouse-gas emissions. More farm animals, then, could mean more environmental trouble.

Some consumers, particularly in the rich West, get this. And that has created a business opportunity. Though unwilling to go the whole hog, as it were, and adopt a vegetarian approach to diet, they are keen on food that looks and tastes as if it has come from farm animals, but hasn’t.

Get our daily newsletter

Upgrade your inbox and get our Daily Dispatch and Editor’s Picks.

Synthetic biologists are the computer programmers of biology. Their code? DNA.

The whole enterprise sounds fantastical: you insert new snippets of DNA code—in the form of a chain of A, T, C, G letters—into an organism, and bam! Suddenly you have bacteria that can make anti-malaria drugs or cells that can solve complicated logic problems like a computer.

Except it’s not that simple. The basis of synthetic biology is DNA—often a lot of it, in the form of many genes. Making an average gene from scratch costs several hundreds of dollars and weeks of time. Imagine a programmer taking a month to type a new line of code, and you’ll likely understand a synthetic biologist’s frustration.