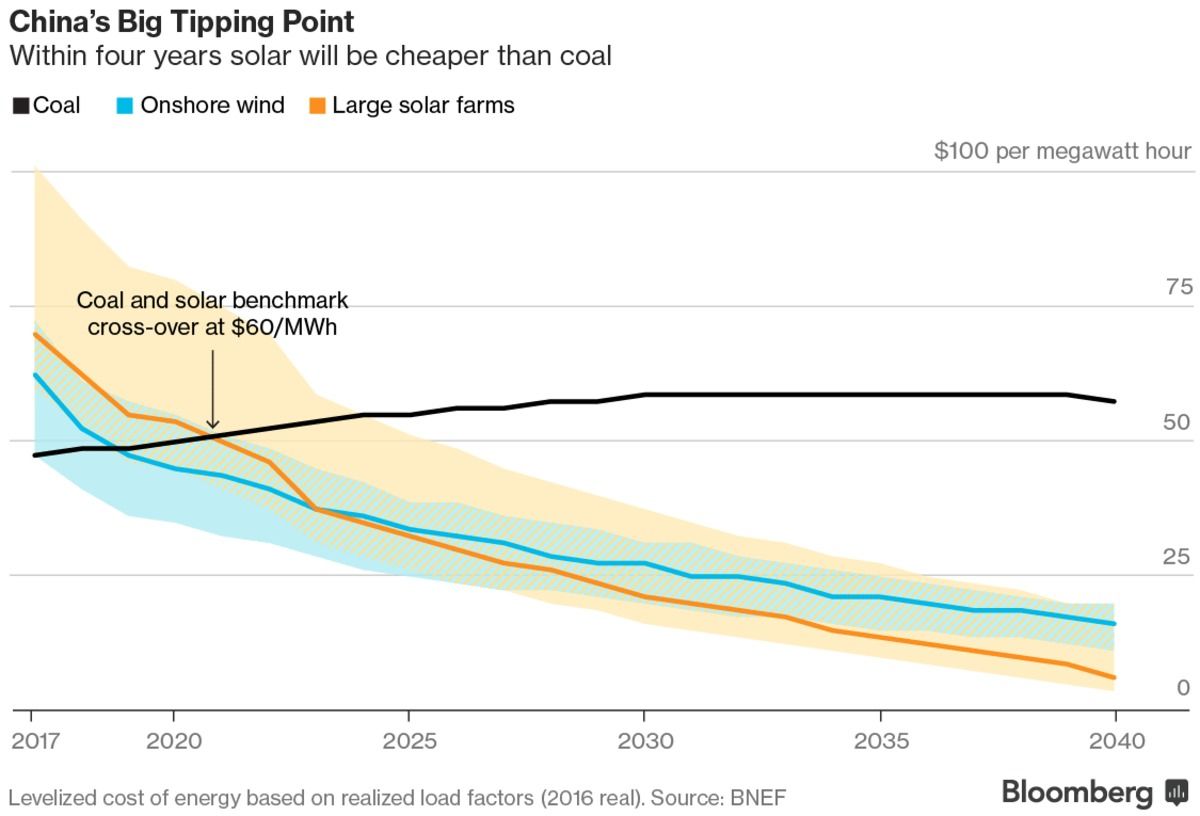

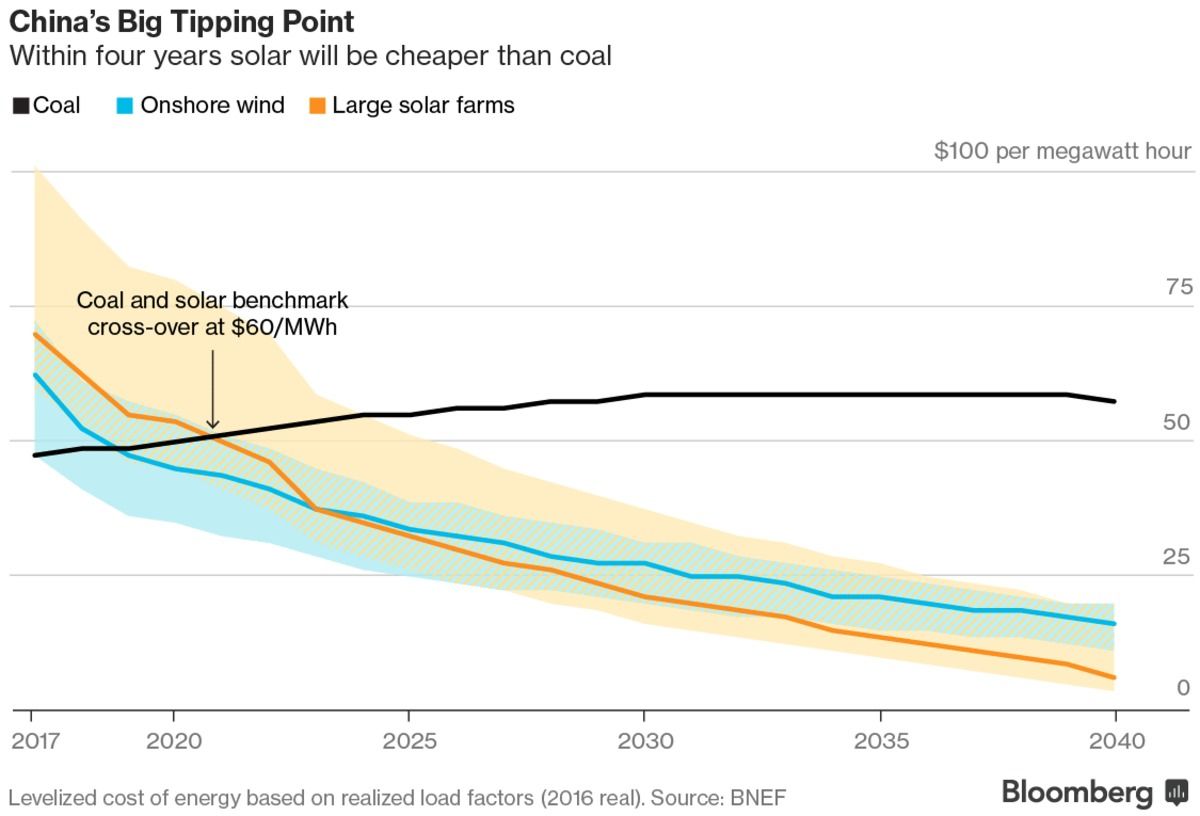

Bloomberg New Energy Finance’s outlook shows renewables will be cheaper almost everywhere in just a few years.

Scientists, technologists, engineers, and visionaries are building the future. Amazing things are in the pipeline. It’s a big deal. But you already knew all that. Such speculation is common. What’s less common? Scale.

How big is big?

“Silicon Valley, Silicon Alley, Silicon Dock, all of the Silicons around the world, they are dreaming the dream. They are innovating,” Catherine Wood said at Singularity University’s Exponential Finance in New York. “We are sizing the opportunity. That’s what we do.”

Ray Kurzweil is an inventor, thinker, and futurist famous for forecasting the pace of technology and predicting the world of tomorrow. In this video, Kurzweil takes a look at the elementary particle of the classical world order, the nation state. Today, news, culture, and financial transactions cross borders in an instant. As technology makes borders less and less relevant, will we witness the end of the nation state as we’ve known it?

Article Image Credit: Stock media provided by BreakingTheWalls/Pond5.com

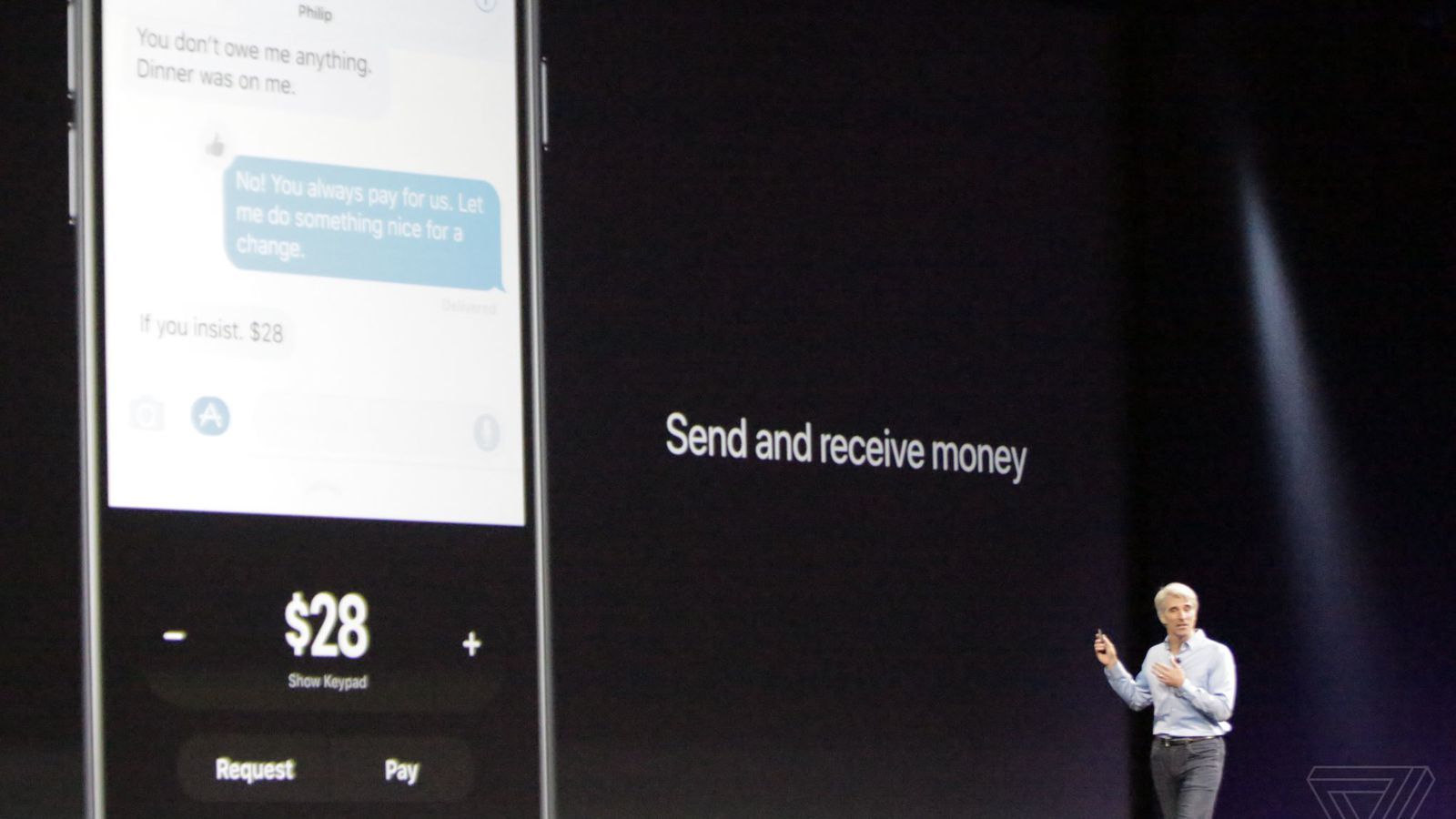

Apple just announced onstage at its Worldwide Developer’s Conference that Apple Pay is getting person-to-person payments. The feature will come in iOS 11, which was announced onstage, and will be available later this year.

It’s an obvious swipe at the part of the payments market that apps like Venmo, PayPal, and Square Cash have cornered. But there’s a catch — P2P payments with Apple Pay will live inside iMessage, and it’s unclear if Apple will let users perform them outside of its messaging app. Also, the money will be transferred to something called an “Apple Pay Cash Card,” which can then be sent to your bank account. That means Apple is not only coming for the Venmos of the world, but maybe the banks themselves.

3½ years ago, I wrote a Bitcoin wallet safety primer for Naked Security, a newsletter by Sophos, the European antivirus lab. Articles are limited to just 500 hundred words, and so my primer barely conveyed a mindset—It outlined broad steps for protecting a Bitcoin wallet.

In retrospect, that article may have been a disservice to digital currency novices. For example, did you know that a mobile text message is not a good form of two-factor authentication? Relying on SMS can get your life savings wiped out. Who knew?!

With a tip of the hat to Cody Brown, here is an online wallet security narrative that beats my article by a mile. Actually, it is more of a warning than a tutorial. But, read it closely. Learn from Cody’s misfortune. Practice safe storage. If you glean anything from the article, at least do this:

Exchange and cloud users want instant response. They want to purchase things without delay and they want quick settlement of currency exchange. But online wallets come with great risk. They can be emptied in an instant. It is not as difficult to spoof your identity as you may think (Again: Read Cody’s article below!)

Some privacy and security advocates insist on taking possession and control of their wallet. They want wealth printed out and tucked under the mattress. Personally, I think this ‘total-control’ methodology  yields greater risk than a trusted, audited custodial relationship with constant updates and best practice reviews.

yields greater risk than a trusted, audited custodial relationship with constant updates and best practice reviews.

In case you want just the basics, here is my original wallet security primer. It won’t give you everything that you need, but it sets a tone for discipline, safety and a healthy dollop of fear.

Philip Raymond co-chairs Crypsa & Bitcoin Event, columnist & board member at Lifeboat, editor

at WildDuck and will deliver the keynote address at Digital Currency Summit in Johannesburg.

UK billionaire investor believes rejuvenation biotechnology will be the next mega-industry.

Many of you may already know about billionaire entrepreneur Jim Mellon and his interest in rejuvenation biotechnology. But for those of you who do not, we would like to introduce you to him and his exciting work.

About Jim Mellon

Jim Mellon is an entrepreneur and investor with interests in several sectors. He also holds a Master’s degree from Oxford in Politics, Philosophy and Economics. From the mid 1980s he worked as a fund manager in Asia and later in the United States until founding his own company in 1991. Jim is the Co-Chairman of Regent Pacific Group Limited, Chairman of Manx Financial Group plc, Chairman of Plethora Solutions Holdings plc, and Chairman of Port Erin Biopharma Investments Limited. He is also a non-executive director of Charlemagne Capital Limited, Condor Gold plc; West African Minerals Corporation; Kuala Innovations Limited and 3Legs Resources plc; and is also a director of Portage Biotech Inc. Jim has been in the top 10% in the Sunday Times Rich List for several years.

A write-up on about neural lace and the future economy: https://altleft.host/zoltan-istvan-the-economy-of-the-future…ural-lace/ #transhumanism

Zoltan Istvan, a leading Transhuman, shows us that the economic system of Technocracy needs Transhuman citizens to make it work. This is not surprising because Transhumanism and Technocracy are two sides of the same coin. ⁃ TN Editor.

The battle for the “soul” of the global economy is underway. The next few decades will likely decide whether capitalism survives or is replaced with a techno-fuelled quasi-socialism where robots do most of the jobs while humans live off government support, likely a designated guaranteed or basic income.

Many experts believe wide-scale automation is inevitable. Even the world’s largest hedge fund, Bridgewater Associates, recently announced it’s building an AI to replace its managers, many of whom are highly educated and previously thought invulnerable to automation. Robots, it seems, will manage everything. Or will they?

A next-generation technology, likely to arrive in five to 10 years, is being credited as the saviour of capitalism. Known today as neural prosthetics, or neural lace, it’s essentially tech that reads your brainwaves. This tech promises to connect our brains to the cloud and AI to link us with machines using thought alone.

Today sees the launch of the biennial UK Space Conference, taking place at Manchester Central, from 30 May through to 1 June. This year’s conference is designed to inspire, enable and connect the UK and international space community.

The multiple plenary and parallel sessions feature informative and interactive presentations, workshops and debates covering a wide range of topics from space science through to how satellite data is being used by many industries here on Earth. The programme has been designed to provide a compelling forum to discuss the changing economic and technological landscape impacting the UK space sector.

Stuart Martin, CEO of the Satellite Applications Catapult, said: “The UK Space Conference provides an invaluable opportunity for those involved or interested in the space sector to gain up-to-date information, network with peers, establish new contacts, exchange information and improve links with government, industry, academia, customers, suppliers, and the financial community.

My topic was #transhumanism and life extension. I’m hoping they might invest in these fields. Former Keynote speakers of this event include Newt Gingrich, Peter Thiel, Andre Agassi, etc. I’ll share a recording of it when I get one. http://familyofficeassociation.com/